College football fans win, schools might eventually lose with new YouTube TV service

It took awhile, but the internet is in full disruption mode when it comes to cable television.

You’ve undoubtedly noticed the myriad new ways in which you can consume television programming in recent years, and yesterday’s announcement of YouTube TV is yet another offering to consider (this one is especially interesting for college football fans). What you might not realize is how this is likely to have major impacts on the future of sports and college football in particular.

Like most major sports, college football is at its core a television product. Everything else is secondary.

The reason, of course, is television-rights related revenue is, by far, the biggest source of revenue for all major sports. The TV money fuels the game. It fuels the coaches’ salaries and the facilities arms race. Yes, many facilities are also funded by capital raising campaigns targeting donors and alumni, but the guaranteed money every year comes from TV. Note: The SEC recently reported that each member institution received just over $40 million in revenue for the 2015-16 fiscal year.

It’s a system built on the back of television money.

The television contracts that sports leagues, including the SEC, have secured are completely built on the traditional cable bundle that most of us have paid for month after month for decades.

And that foundation is crumbling fast.

ESPN has been and continues to be the focal point for the crumbling cable bundle. As Clay Travis explained a few months ago:

“This isn’t just a story about ESPN, the rapid decline in cable subscribers is hitting every channel, sports and otherwise. It just impacts ESPN the most because ESPN costs every cable and satellite subscriber roughly $7 a month, over triple the next most expensive cable channel.

“Yep, if you have a cable or satellite subscription, whether you watch ESPN or not, you’re paying ESPN over $80 a year.

“What does ESPN do with that money?

“It buys sports rights.

“Presently ESPN is on the hook for the following yearly sports rights payments: $1.9 billion a year to the NFL for Monday Night Football, $1.47 billion to the NBA, $700 million to Major League Baseball, $608 million for the College Football Playoff, $225 million to the ACC, $190 million to the Big Ten, $120 million to the Big 12, $125 million a year to the PAC 12, and hundreds of millions more to the SEC.”

In 2017 ESPN to spend $7.3 billion on content more than any source; then Netflix ($6bn), NBC (4.3bn), CBS ($4bn) & Amazon ($3.2bn) #snlkagan

— Brad Adgate (@badgate) October 18, 2016

The problem for ESPN is that they’ve been losing subscribers at a rapid rate for several years. It’s not necessarily ESPN’s fault. More and more individuals are opting out of cable TV altogether.

It seems reasonable to expect that this trend will not be reversed. It’s a secular trend, it appears firmly in place and ESPN can project continually cable subscriber declines for years.

Most sports leagues, including the SEC, have locked in contracts with television providers such as ESPN for many years, but when those contracts are up for renewal, it’s reasonable to expect a significant adjustment in the market.

This adjustment might mean that we never see the kind of guaranteed television revenue we’re accustomed to reading about for the sports leagues. For college football, it might mean that leagues like the SEC don’t see the level of guaranteed revenue.

The flip side of the argument is that live sports is becoming even more valuable as television ratings across the board decline. It’s not an unreasonable argument. While every piece of programming becomes more and more geared toward on-demand, binge-like consumption, live sports remains the one area where you have to watch live. But recent soft ratings on marquee franchises such as Monday Night Football indicate that even live sports are not immune to the macro shifts in television consumption that we’re seeing.

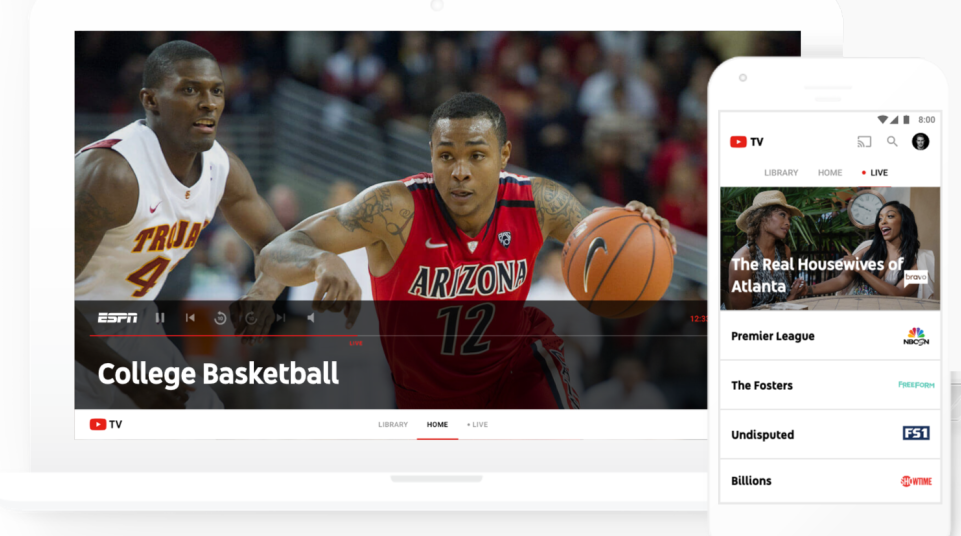

Yesterday, Google announced that YouTube TV will launch in select markets offering consumers a very live sports friendly “skinny bundle” of channels for $35/month.

Here are all the YouTube TV channels available at launch pic.twitter.com/C0eWHyfnzB

— Rich DeMuro (@richdemuro) February 28, 2017

As one can see very quickly, essentially all channels in which a fan might find a college football game are covered. It’s an offering that certainly is worth taking a look at if your primary purpose in holding cable is to watch college football each fall.

The new service will allow you to watch live television on your computer and mobile device (though NFL streaming on mobile will be restricted). Also interesting is the idea of unlimited cloud-based DVR. I can get behind that.

What’s missing? Most notably, Turner channels such as TNT and TBS and popular drama channel AMC. Note: Dish Network’s Sling TV offering has always included the Turner Channels and AMC (but often lacked the major broadcast channels).

In the end, more options for consumers mean that the consumers win.

Even better for consumers is the fact that large companies that are getting into the mix of live television are not concerned about near term profitability. Companies like Amazon, Google and Netflix will spend billions on content and customer acquisition in an effort to simply build a large customer base for the future. Where cable companies are trying to win the next quarter, the Silicon Valley darlings such as Google are trying to win the next 30 years.

YouTube will almost certainly lose $ selling TV bundle for $35. Which they should since THEY ARE FUNDED BY GOOGLE.

— Peter Kafka (@pkafka) February 28, 2017

Google willing to potentially lose money for years on YouTube TV to gain customers will only put increasing amounts of pressure on cable companies. As the traditional cable bundle continues its long-term decline, expect more changes at companies such as ESPN. Its cash cow is dying a slow death.

How will this affect your favorite football program? Not much in the near future. College coaches will rake in millions and facilities will continue to get built. But smaller conferences looking for their share of the pie might find it increasingly difficult. Most notably, when major sports leagues begin renegotiating the television rights with networks in the next decade, TV might not look anything like it did when they were previously negotiated.